about getting you the right result.

At Steadfast Life, our ultimate focus is to help ensure cover is there when you need it. So accordingly, we take the time upfront to get this right.

We make sure we get to know you and your needs before we research the market to recommend appropriate cover for your circumstances.

Importantly, we do the research and have access to all insurers and are not restricted to any particular insurance provider.

However, we don’t believe that any insurance should be a ‘set and forget’. We understand that circumstances change, so we undertake annual reviews to check that your cover is suited to life’s changing needs.

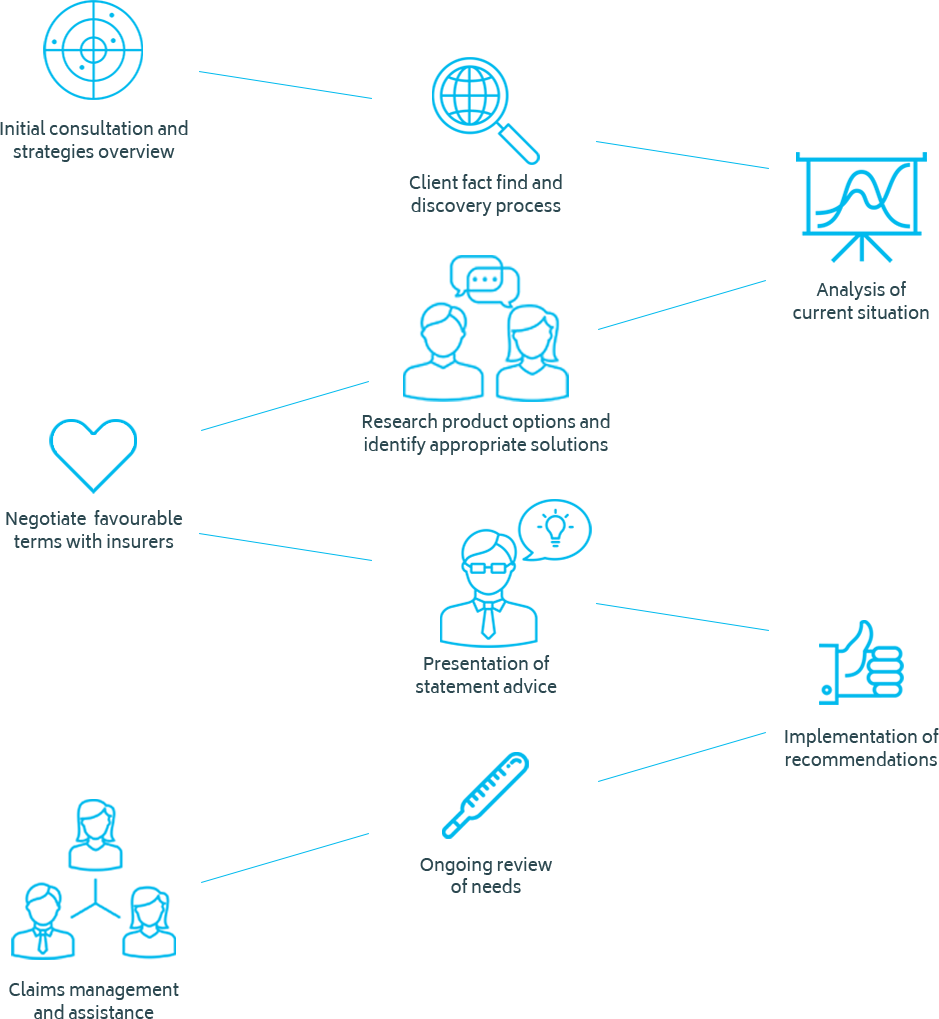

Here’s a snapshot of how we make sure you have cover when you need it:

Claims Management

At Steadfast Life, we have a team dedicated to helping our clients through the process of claiming on their insurance. We’re committed to supporting you in your time of need and should the unexpected occur, we’ll be on your side to ensure your claim is looked after.

We take pride in our history of supporting clients at this difficult time.